A new year, now what?

Tips for ensuring a successful year for your organization’s FSA plan

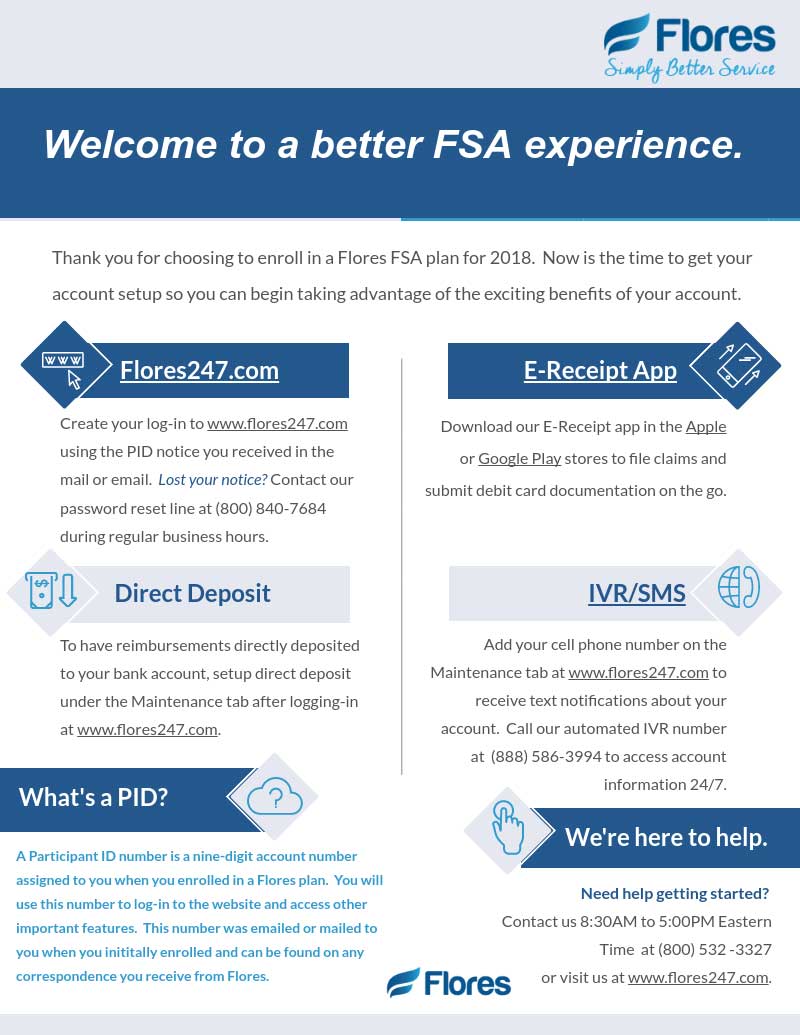

Charlotte, NC – January 9, 2018 – You did your due diligence and selected Flores as your FSA administrator for 2018. Now that your plan year has begun, here are a few tips that can help make administration easier in the new year:

- Pay attention to funding requests

- Review Flores weekly reports

- Create a log-in for www.flores247.com and use it

- Educate employees on FSA frequently

- Integrate other benefits into your Flores plan

During the implementation process, your account manager discussed FSA funding options with you and you selected how your plan would be funded. Timely funding of your plan is critical to employee satisfaction, particularly for Dependent Care and QTE (transit) participants who must fund their account before obtaining reimbursements. Timely responses to funding requests help us reimburse employees faster, meaning greater employee satisfaction with both Flores and their employer.

Flores provides transparent weekly balance reporting via email as well as detailed on demand reporting options on your administrator website, www.flores247.com. Take advantage of these reports to periodically audit your plan to ensure deductions were reported correctly and that Flores was notified of any terminations and new hires.

We offer various detailed reports on flores247.com to provide transparency and account integrity. You can also enroll employees, terminate employees, and access a robust resource guide to get more information on Flores plans. If you haven’t already received a tour of the administrator site, ask your dedicated account manager to setup a tutorial on the features we have available.

FSA is an inexpensive benefit that has big returns for both employees, in the form of tax savings, and employers, in the form of FICA savings. Employees who use their FSA plan are more satisfied and likely to enroll in the plan again. Take advantage of the periodic resources Flores provides via email as well as the resource library available at www.flores247.com to educate your employees and encourage them to use their FSA.

The FSA is just one part of a comprehensive benefit package. Flores can help streamline HR function through integrating other services into the Flores platform you trust. Contact your dedicated account manager to learn about how Flores COBRA, HSA, and HRA services can make administration easier for both you and your employees through one easy, single source solution.

About Flores & Associates

Flores is a leading national administrator of tax advantaged consumer based reimbursement plans such as health and dependent care spending accounts (FSAs), health reimbursement arrangements (HRAs), health savings accounts (HSAs) and qualified transportation expenses (QTEs). Additionally, Flores handles COBRA administration and billing services for employers. Based in Charlotte, NC, Flores has emerged as the leader in this field through a service model founded upon innovative technology, dedicated professionals, and an uncompromising commitment to superior service.

Contact

To learn more about the services offered by Flores & Associates, existing clients may contact their dedicated account manager. Brokers, potential clients, and media representatives may contact:

- Cindy Bistany

- Director of Business Development and Strategic Alliances

- (828) 693-3595

- cindy@flores-associates.com

- Clay Peddycord, GBA, CFC

- Director of Business Development and Strategic Alliances

- (800) 532-3327

- clay.peddycord@flores-associates.com

- Aaron Hunt, MBA, CDHC, HSAe, Certified COBRA Administrator

- Director of Business Development and Strategic Alliances

- (800) 532-3327

- aaron.hunt@flores-associates.com