Section 125 Non-Discrimination Testing

The IRS requires that all Section 125 Cafeteria Plans comply with non-discrimination regulations to ensure that each plan does not favor highly compensated and/or key employees of the organization. Each plan must pass this testing at least once in the plan year in order to be in compliance.

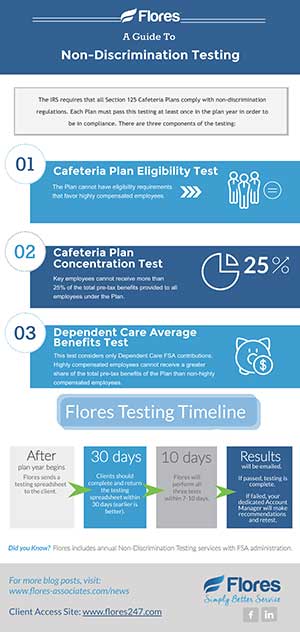

Charlotte, NC – February 21, 2018 – The IRS requires that all Section 125 Cafeteria Plans comply with non-discrimination regulations to ensure that each plan does not favor highly compensated and/or key employees of the organization. Each plan must pass this testing at least once in the plan year in order to be in compliance. There are three tests Flores performs for our FSA clients that must be satisfied in order to comply:

- Cafeteria Plan Eligibility Test

- Cafeteria Plan Concentration Test

- Dependent Care Average Benefits Test

The Plan cannot have eligibility requirements that favor highly compensated employees.

Key employees cannot receive more than 25% of the total pre-tax benefits provided to all employees under the Plan.

This test considers only Dependent Care FSA contributions. Highly compensated employees cannot receive a greater share of the total pre-tax benefits of the Plan than non-highly compensated employees.

Annual Non-Discrimination testing is performed as a part of our standard FSA administration services. Please contact your dedicated Account Manager with any questions you may have about this service.

About Flores & Associates

Flores is a leading national administrator of tax advantaged consumer based reimbursement plans such as health and dependent care spending accounts (FSAs), health reimbursement arrangements (HRAs), health savings accounts (HSAs) and qualified transportation expenses (QTEs). Additionally, Flores handles COBRA administration and billing services for employers. Based in Charlotte, NC, Flores has emerged as the leader in this field through a service model founded upon innovative technology, dedicated professionals, and an uncompromising commitment to superior service.

Contact

To learn more about the services offered by Flores & Associates, existing clients may contact their dedicated account manager.

Brokers, potential clients, and media representatives may contact:

- Cindy Bistany

- Director of Business Development and Strategic Alliances

- (828) 693-3595

- cindy@flores-associates.com

- Clay Peddycord, GBA, CFC

- Director of Business Development and Strategic Alliances

- (800) 532-3327

- clay.peddycord@flores-associates.com

- Aaron Hunt, MBA, CDHC, HSAe, Certified COBRA Administrator

- Director of Business Development and Strategic Alliances

- (800) 532-3327

- aaron.hunt@flores-associates.com